Supplier Enablement

Streamline your payment process, cut costs and maximize

card spend with suppliers!

When migrating from checks to electronic payments in your Accounts Payable department, a critical component is vendor enrollment. For your automated AP process to be successful, your vendors must be enrolled on the new platform to receive payments. But how do you get them to enroll in the program? And where do you find the time and internal resources for outreach to your hundreds — or even thousands — of vendors?

Our Monecity Supplier/Vendor Enablement team can help by contacting vendors on your behalf. You can benefit from the extensive experience of the Monecity Enablement Specialists in vendor outreach, as well as an inventory of proven best practices designed to ensure optimum enrollment success. In addition, we have a strong history of convincing vendors to begin accepting cards for electronic payments. We can help you bridge that gap with your vendors.

Value

• A clear strategy will be provided that allows you to:

• Approve all vendors to be contacted.

• Direct the pace and tone of the enrollment process.

• Configure vendor communications to your organization’s brand and culture.

• Receive timely reporting of enrollment results.

• Our dedicated teams consult with you to ensure the highest quality of communication among stakeholders.

• You’ll be provided detailed reporting that contains individual vendor response information.

• After the project ends, we can assist you with ongoing vendor enrollment, including training your organization to implement individual vendors as needed, execute organized re-contact campaigns and perform outreach for lists of new vendors (typically 50+).

“Over 20,000 organizations and hundreds of thousands of vendors are already enabled on Monecity’s Paygenus network, improving opportunities for acceptance. In addition, the Paygenus Enablement Specialists have in-depth knowledge of standard acceptance procedures of vendors (file-driven, single-use virtual accounts, etc.), allowing an immediate impact to be made.”

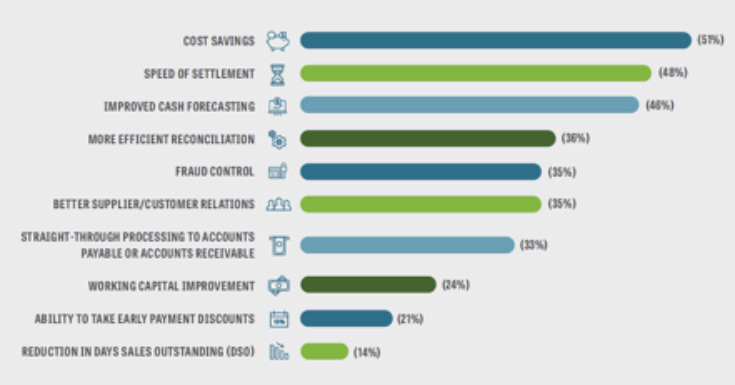

Benefits

Company Benefits

• More streamlined and secure payments.

• Potential new source of revenue based on transaction volume.

• Lower costs by reducing paper checks.

• Stronger vendor relationships.

• Greater visibility into overall spend.

Vendor Benefits

• Reduced Account Reconciliation costs.

• Expedited cash receipt and increased cash flow (through improved Days Sales Outstanding).

• Competitive advantage over vendors who do not accept electronic payments — b/c you are more likely to do business with vendors who accept electronic payments.

• Elimination of check processing costs (including banking fees and internal admin costs).

• Reduced exposure to check fraud and ACH fraud.

• Superior remittance data transmitted with the payment for more efficient back-end reconciliation.

• Entry into the secure and established card payment infrastructure, which is used for billions of transactions each year.

As businesses seek to improve cash flow, Supplier terms management can be a valuable strategy to improving and optimizing the cash conversion cycle which can ultimately help improve both the income statement and balance sheet. Our Managed Payables solution leverages the value of terms management by delivering a seamlessly integrated, fully automated solution leveraging all payment modalities – including virtual accounts, ACH with discount administration, or check – that will connect Buyers with their Suppliers through a simple pay file integration. Our Managed Payables reduces manual processing and facilitates comprehensive supplier/terms management to maximize margin improvement, efficiency and control – for ultimate payment optimization.